Investing in stocks can be tricky, as the market's past performance doesn't always indicate what's to come. However, knowledge is power, and noticing past patterns can help ensure you're ready to strike if history decides to repeat itself. As a result, it can only help investors to know that history suggests the Nasdaq Composite could surge in 2024.

Since the index launched in 1971, it has risen by an average of 19% in each year that followed a market recovery of the magnitude seen in 2023. Consequently, it's not a bad idea to consider investing in the companies fueling the bulk of the Nasdaq Composite's growth.

The phrase "Magnificent Seven" was coined last year to describe the seven most prominent tech companies, which include Alphabet, Amazon (NASDAQ: AMZN), Apple, Meta Platforms, Microsoft, Nvidia (NASDAQ: NVDA), and Tesla. These companies rule tech, and many were key players in the market's stellar recovery last year.

The Magnificent Seven could be an excellent place to invest and profit from a potential surge in the Nasdaq composite in 2024. So, here are two Magnificent Seven stocks to buy right now.

1. Nvidia

Whether you're a casual investor or trade professionally, you're likely aware of Nvidia's meteoric rise last year. Its stock soared by 239% in 2023 as its graphics processing units (GPUs) became the gold standard for artificial intelligence (AI) developers everywhere. These high-powered parallel-processing chips are crucial for training and powering AI models, with increased demand causing Nvidia's earnings to skyrocket.

The company achieved an estimated 90% market share in AI chips while rivals like Advanced Micro Devices and Intel scrambled to catch up on the technology front.

In Nvidia's most recent quarter (the fiscal fourth quarter of 2024, which ended in January), the company's revenue increased by 265% year over year to $22 billion. Meanwhile, operating income jumped 983% to nearly $14 billion. This monster growth was primarily thanks to a 409% increase in data center revenue, reflecting a spike in AI GPU sales.

Competition in the AI chip space is expected to heat up this year, with AMD and Intel bringing powerful new hardware to market. However, in addition to soaring earnings, Nvidia's free cash flow is up 430% in the last year to $27 billion, significantly higher than AMD's $1 billion and Intel's negative $14 billion.

So, despite new GPU releases from both competitors, Nvidia's head start in AI potentially pushed it further ahead with greater cash reserves to continue investing in its technology and retain market supremacy.

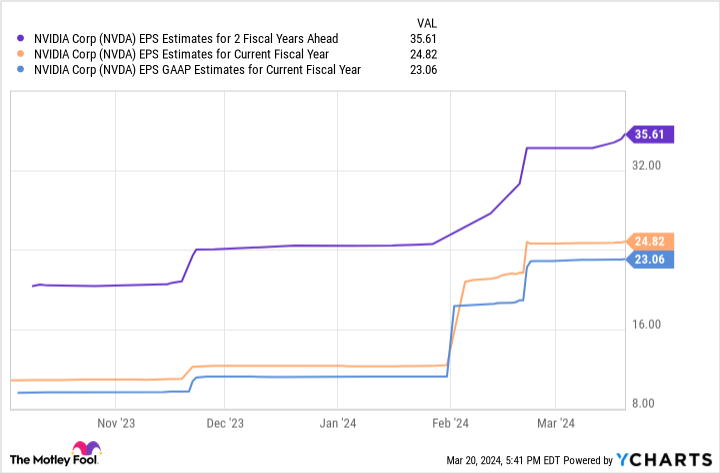

The table above shows Nvidia's earnings could hit close to $36 per share by fiscal 2026. Multiplying that figure by its forward price-to-earnings (P/E) ratio of 37 yields a stock price of about $1,300.

Considering the company's current position, that projection would see Nvidia's stock rise 44% over the next two fiscal years. Given its prominent position in AI, Nvidia is a Magnificent Seven stock that's too good to pass up.

2. Amazon

Amazon has come a long way since starting as an online book retailer out in Seattle almost 30 years ago. The tech giant has expanded to multiple industries, from becoming a titan of e-commerce to leading the cloud market, developing space satellites, and venturing into grocery, gaming, consumer tech, and more.

But all eyes have been on Amazon's AI efforts over the last year. As the operator of the world's biggest cloud service, Amazon Web Services (AWS), the company has the potential to leverage its massive cloud data centers and steer the generative AI market.

In 2023, AWS responded to increased demand for AI services by introducing a variety of new tools. Amazon is even using AI to boost its retail site. It announced an AI shopping assistant dubbed Rufus ahead of its latest earnings release.

In fiscal 2023, Amazon's revenue rose 12% year over year, with operating income more than tripling to $37 billion. A solid recovery in its e-commerce earnings over the last year has seen Amazon's free cash flow soar 904% to over $32 billion, indicating the company has the funds to continue investing in its business and overcome possible headwinds.

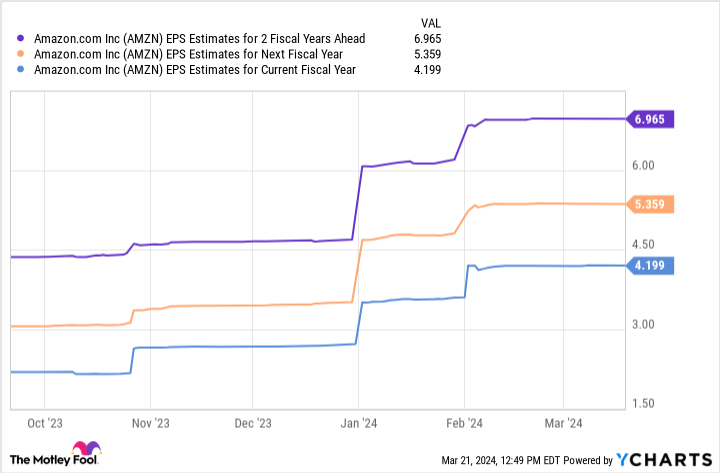

The chart above indicates that Amazon's earnings could achieve nearly $7 per share by fiscal 2026. When multiplying that by its forward P/E of 43, you get a stock price of $300.

This projection would see Amazon's stock rise 68% from its current value over the next two fiscal years. As a result, the company is worth considering before its share price surges.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service hasmore than tripledthe return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

History Suggests the Nasdaq Will Surge in 2024: 2 "Magnificent Seven" Stocks to Buy Right Now was originally published by The Motley Fool