- HubPages»

- Personal Finance»

Updated on November 29, 2012

Contact Author

First Response to Pay Off Debt: Stop Spending

When a patient is rushed by ambulance and wheeled on a gurney into an emergency room, one of the first things medical personnel will do is to try and stop the bleeding. They know that without that precious source of life flowing in the veins and arteries of a patient, there is no hope.

The same is true of your financial situation if you're in debt. The first thing you have to do is stop the spending. Do what is necessary to stop using your credit cards and any unsecured credit accounts. I have heard of some folks who place their credit cards into a big block of ice and store them in the bottom of their deep freeze. I've heard of others who place all their credit cards in a safe deposit box. The purpose of any of these methods is to make it hard to gain access to and use credit cards.

Whatever you decide to do, keep at least one credit card handy for emergency use. Let me say that emergencies do not include a pair of shoes that you must have or picking up the check for a big dinner party. If you're going to pay off your debt, those days of paying for everything and impulse buying with a credit card are over. Use cash for all expenses and keep the credit card at home.

.

Look at the Big Credit Picture

The first thing you need to do is see the "big picture" of your particular financial situation. Sometimes you can't see the forest for the trees. Being buried in a pile of bills and debt is very similar. Sometimes you get so focused on the details right in front of you that you don't see the overall big picture. Everyone has some sort of debt but there are debts that are acceptable (secured debts) and those that are not (unsecured debts).

Credit Cards Are Enemy #1

Credit cards are on the top of the list for unsecured or bad debt. On a sheet of paper, divide your debt into two columns - secured debt like mortgages, car loans, student loans, etc. in one column. Put the rest of your unsecured debt - like credit cards, revolving accounts, payday loans, etc. into the second column.

Let's say the total amount of unsecured bad debt is $5000.00. Take the total amount from column 2 - let's say it is $5,000 - and divide the total amount of unsecured debt by your annual net income (after taxes) - let's say that is $28,000.00.

Figure it out using this equation:

$5,000 ÷ $28,000 = 17.85% (debt-to-income ratio)

That 17.85% is your debt-to-income ratio and it is too high. Yes, most banks will tell you that a debt-to-income ratio of around 15% of your after-tax income is acceptable. Just remember that banks and credit cards profit from your debt. I try to keep that ratio as close to zero as possible. Maybe you think that is ridiculous but I know people who have attained zero debt and are very pleased about it. Remember to keep your "good" debt out of the equation and focus on repaying the bad, unsecured debt.

.

Use a "Pay Off Debt" Calculator

Do you know how long it will take to pay off a high-interest credit card bill by just making monthly payments. Here's an example: I have a 15.9% interest rate credit card that has a balance of 1,025.00. The easiest way to get an accurate assessment of what it's going to take to get a credit card or loan paid off is to use a pay off debt calculator. These calculators can be found online by simply typing in the search term "pay off debt calculator" on Google or similar search engines.

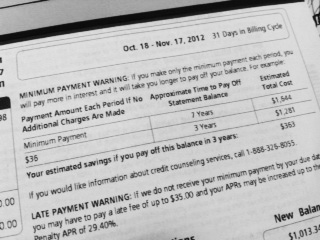

You can also look at the details on your monthly loan or credit card statement. According to my current statement, if I only pay the minimum monthly payment, it will take me 7 years to pay off this balance and cost me another $619.00 in total interest payments.

• Minimum payment of $28/mo on $1,025 balance adds $619 interest = $1,644 in total payments over 7 years

If I pay just $8.00 more each month, I can pay off that balance in just 3 years at a cost of only $256.00 in total interest payments - a savings of $363.00 by just paying $8.00 additional every month.

• Minimum payment of $36/mo on $1,025 balance adds $256 interest = $1,281 in total payments over 3 years

Now just imagine how much you can save if you pay a bit more each month on all your credit cards. I think you can see the huge difference a few additional dollars can make over a short period of time.

Credit card companies in the U.S. typically provide basic information on your statement that tells you how long it will take to pay off a credit card balance if you just pay the minimum amount. (See figure above)

.

Negotiate Lower Balances and Lower Interest Rates

The next thing to do is get on the phone and start working on getting some costs reduced. To get a lower interest rate, just ask for it. Most creditors are willing to work with you and will lower your interest rate, especially if you're working to pay off the debt.

If you're in deep debt and monthly payments are more than you can afford, you may need to negotiate a settlement on the total amount owed. Start by asking the creditor to make an offer for a reduced amount and then present a counter offer.

Figure what you can afford to pay before you negotiate for a lower or reduced balance amount. For example: On a debt amount of $5,000 you may want to offer the creditor $3,000 to settle the debt. This is known as a debt settlement and you do not need a debt-relief consultant or attorney to do this.

Regarding debts settled for a lower amount, creditors may be willing to negotiate a lower total amount of debt owed if you can come up with a lump sum settlement. A lump sum settlement means you will pay a portion of the total amount right away in exchange for forgiveness on a portion of the total debt. For example, If you owe $5,000, you can offer to pay a $3,000 lump sum payment to settle the account. The creditor would agree to forgive $2,000 of the total amount owed and accept your offer of $3,00 instead of the $5,000 owed.

Please be aware that any negotiated settlement amounts forgiven will be reported as income by the creditor. In the example above, $2,000 would be reported as income to the IRS and you may have to pay taxes on that income. Let me also clarify that you should pay the full amount of what you owe if you can afford it.

.

The Bottom Line on How to Pay Off Debt

Remember, the ultimate goal is to pay off and get rid of all "bad" or unsecured debt. Stop all credit card spending. Assess your financial situation and determine your debt-to-income ratio. Use a "debt pay off" calculator to figure put how much you can pay off each month. Negotiate lower interest rates and settle for lesser amounts if you truly cannot pay all your debt. Focus on allocating all available funds to paying off debt as soon as possible.

If your situation is desperate and you are one of the unfortunate folks who have lost one or both jobs or maybe a house, you may be in a tough financial spot. Bankruptcy may seem like the only available alternative for some folks. For others, bankruptcy should only be considered as a last resort. You should also be aware that bankruptcy may not take care of all your debt.