How to prepare a cash flow forecast?

The first step to preparing a cash flow forecast is to identify and categorize your sources and uses of cash. Cash inflows are the money that comes into your business from sales, receivables, investments, loans, or other income streams.

The first step to preparing a cash flow forecast is to identify and categorize your sources and uses of cash. Cash inflows are the money that comes into your business from sales, receivables, investments, loans, or other income streams.

What is a cash forecasting template? A forecasting template (also known as a cash forecasting model) is a blueprint that finance teams use for cash flow projection. Typically, the document sets out the key dimensions of a forecast model — the time horizon, time-period granularity, and cash flow categories.

The net cash flow formula is: Cash Received – Cash Spent = Net Cash Flow. Cash received corresponds to your revenue from settled invoices, while cash spent corresponds to your business' liabilities (costs such as accounts payable, interest payable, incomes taxes payable, notes payable or wages/salaries payable).

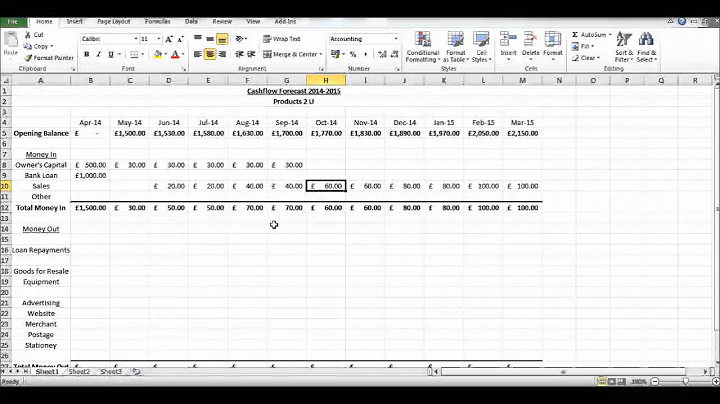

The principle for the 12 month cash flow forecast is very simple: you compare the expected income with the expected expenditure for each month.

Cash flow forecasting involves estimating the future inflows and outflows of cash for a specific period. It is typically calculated by starting with the opening cash balance, adding cash inflows (sales receipts, loans, or investments), and subtracting cash outflows (expenses, loan repayments, or taxes).

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure.

Free Excel Cash Flow Template

Download Xlteq's free Cash Flow Template to assist with managing and reporting for your business. This free cash flow template shows you how to calculate cash flow using a simple cash flow statement. Our cash flow template helps measure your company's financial performance.

The cash flow statement records the actual money coming in and going out during a specific period, showing the company's financial health, whereas a cash flow forecast predicts future cash flows, helping businesses plan and ensure they have enough cash to meet obligations.

Cash flow projections typically take less than an hour to produce but can go a long way in helping entrepreneurs identify and prepare for a potential shortfall, and make smarter choices when running their business.

What is an example of a cash flow projection?

Cash flow projections show the amount of cash on hand at the beginning and at the end of each month. For example, Company XYZ has the following projected income and expenses for the month of January: At the beginning of January, a company has $10,000 in cash. Income for the month is projected to be $30,000.

The Cash Flow Calendar presents predictions of future cash flows (cash coming in and going out) for a business in a daily calendar view, based on an analysis of past transactions.

As with any forecast, a projection of future cash flows cannot account for all the factors that can affect a business and cash inflows and outflows. Any business operates in an open system, so cash flow forecasts cannot be 100% accurate.

There are two primary types of forecasting methods: direct and indirect. The main difference between them is that direct forecasting uses actual flow data, where indirect forecasting relies on projected balance sheets and income statements.

To calculate cash flow in Excel, you input income and expenses into separate cells, then use the SUM function to find monthly totals. Annual cash flow is the sum of these monthly figures across one year.

To keep your cash flow projections on track, create a rolling 12-month plan that you update at the end of each month. If you add a new month to the end every time a month is completed, you'll always have a long-term grasp of your business's financial health.

To calculate FCF using sales revenue, take the revenue generated by the company through its business and subtract the cost that is associated with generating that revenue (known as operating expenses; the sum of taxes, and all the operating costs) along with the net investment in operating capital.

One of the best ways to improve the accuracy of cash flow forecasts is to make it a habit. Updating your forecast as often as possible with new information can drastically improve its accuracy. Furthermore, forecasting over long periods of time helps uncover certain trends.

What should be included in a cash flow forecast? There are three key elements to include in a cash flow forecast: your estimated likely sales, projected payment timings, and your projected costs.

A short-term cash flow forecast is a predictive model that attempts to estimate cash inflows and outflows over a period that is typically less than 12-months. Often, short-term cash flow forecasts are for even shorter periods, depending on the importance of maintaining sufficient cash balances.

How do you read a cash flow forecast?

How to read a cash flow forecast. The numbers to watch. Net cash flow – shows whether you'll be putting money in the bank, or scrambling to meet costs. Closing balance – a negative amount suggests you may need to delay expenditures if you can, or sort out some kind of finance.

To calculate operating cash flow, add your net income and non-cash expenses, then subtract the change in working capital. These can all be found in a cash-flow statement.

The projected cash flow formula is Projected Cash Flow = Projected Cash Inflows – Projected Cash Outflows. It calculates the anticipated net cash flow by subtracting projected expenses from projected revenues, considering all sources of inflows and outflows.

Start with net income: Obtain this from the income statement. Adjust for non-cash items: Add back depreciation and amortization. Adjust for changes in working capital: Account for changes in accounts receivable, inventory, accounts payable, and other working capital accounts.

Businesses can generate cash flow statements using either the indirect or direct method. The indirect method, starting with net income and adjusting for noncash items and balance sheet changes, is simpler and more commonly used, especially by larger firms, because it's efficient and easy to prepare.