What is the formula for NPV cash flow?

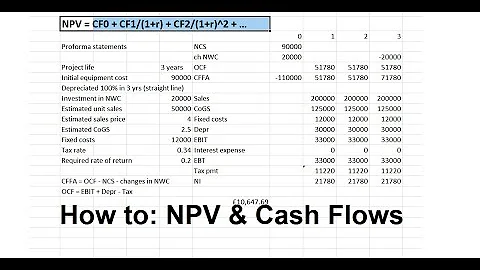

Here's the NPV formula for a one-year project with a single cash flow:NPV = [cash flow / (1+i)^t] - initial investmentIn this formula, "i" is the discount rate, and "t" is the number of time periods.

In reality, we can evaluate any stream of cash flows by using FV = PV × (1 + i) n or PV = FV ÷ (1 + i) n for each cash flow.

Net Cash Flow = Total Cash Inflows – Total Cash Outflows. Learn how to use this formula and others to improve your understanding of your cash flow.

Example 1: An investor made an investment of $500 in property and gets back $570 the next year. If the rate of return is 10%. Calculate the net present value. Therefore, for 10% rate of return, investment has NPV = $18.18.

- Step 1) Create a sheet and set up values: In this example, we will calculate the NPV over a 10 years period. The Discount Rate, return of requirement is set to 10%. ...

- Step 2) Start the NPV Function: Select cell E9. Type =NPV. ...

- Step 3) Enter NPV Values: Select B9 to Apply "rate"

- NPV = Cash flow / (1 + i)^t – initial investment.

- NPV = Today's value of the expected cash flows − Today's value of invested cash.

- ROI = (Total benefits – total costs) / total costs.

Net present value (NPV) is used to calculate the current value of a future stream of payments from a company, project, or investment. To calculate NPV, you need to estimate the timing and amount of future cash flows and pick a discount rate equal to the minimum acceptable rate of return.

You'll find this information in your financial statement. Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital.

Net cash flow = Total cash in – Total cash out

The total cash inflow includes rent as well as income like pet rent and laundry fees, whereas the total cash outflow includes expenses like maintenance and financing costs.

Conceptually, the net cash flow equation consists of subtracting a company's total cash outflows from its total cash inflows.

What is the formula for NPV manually?

NPV = F / [ (1 + i)^n ]

Where: PV = Present Value. F = Future payment (cash flow) i = Discount rate (or interest rate)

Net Present Value (NPV)

Put more simply, NPV tells you what the present value of an investment or project (specifically the cash flows) is at a required rate of return (discount rate or hurdle rate). When to use NPV? NPV is used to evaluate projects or investments to tell you what your return will be.

The formula used to calculate the present value (PV) divides the future value of a future cash flow by one plus the discount rate raised to the number of periods, as shown below.

What is the Net Cash Flow Formula? Put simply, NCF is a business's total cash inflow minus the total cash outflow over a particular period.

NPV analysis is used to help determine how much an investment, project, or any series of cash flows is worth. It is an all-encompassing metric, as it takes into account all revenues, expenses, and capital costs associated with an investment in its Free Cash Flow (FCF).

Examples of Net Present Value

To illustrate the concept of NPV, consider the following examples. Example 1: You invest $2,000 in a project and expect to receive $3,000 in cash flows over the next five years. In this example, the NPV is $8,250, meaning the project is expected to generate a positive return of $6,250.

=NPV(rate,value1,[value2],…)

The NPV function uses the following arguments: Rate (required argument) – This is the rate of discount over the length of the period. Value1, Value2 – Value1 is a required option.

Net present value method is a tool for analyzing profitability of a particular project. It takes into consideration the time value of money. The cash flows in the future will be of lesser value than the cash flows of today. And hence the further the cash flows, lesser will the value.

Here's the NPV formula for a one-year project with a single cash flow:NPV = [cash flow / (1+i)^t] - initial investmentIn this formula, "i" is the discount rate, and "t" is the number of time periods.

To calculate free cash flow, add your net income and non-cash expenses, then subtract your change in working capital and capital expenditure.

Is NPV the sum of cash flows?

Present value (PV) is the current value of a future sum of money or stream of cash flow given a specified rate of return. Meanwhile, net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

The projected cash flow formula is Projected Cash Flow = Projected Cash Inflows – Projected Cash Outflows. It calculates the anticipated net cash flow by subtracting projected expenses from projected revenues, considering all sources of inflows and outflows.

Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments). These items are all listed in a cash flow statement, but can also be identified by comparing non-current assets on the balance sheet over two periods.

The operating cash flow ratio is calculated by dividing operating cash flow by current liabilities. Operating cash flow is the cash generated by a company's normal business operations.

- Net Cash Flow = Net Cash Flow from Operating Activities + Net Cash Flow from Financial Activities + Net Cash Flow from Investing Activities.

- Net Cash Flow = Total Cash Inflows – Total Cash Outflows.

- 100,000 + 40,000 – 60,000 = 80,000.