What to invest in 2024?

Against this backdrop, here's why high-quality AI-powered stocks such as Nvidia (NVDA 3.73%), Super Micro Computer (SMCI 4.57%), Snowflake (SNOW -0.40%), Palantir Technologies (PLTR -1.00%), and UiPath (PATH -0.42%) can prove to be smart buys in 2024.

Against this backdrop, here's why high-quality AI-powered stocks such as Nvidia (NVDA 3.73%), Super Micro Computer (SMCI 4.57%), Snowflake (SNOW -0.40%), Palantir Technologies (PLTR -1.00%), and UiPath (PATH -0.42%) can prove to be smart buys in 2024.

High-yield savings accounts and CDs offer ways to offset the effects of inflation. Funds are an affordable way to diversify and invest in bundles of stocks or bonds. Government and corporate bonds can provide a source of income and cushion stock market volatility.

Health and Insurance Sector

According to Invest India, the health sector is likely to grow by 16-17% and is about to hit $372 billion by 2024. The major components of the health and insurance sector are hospitals, Diagnostics, Medical insurance, Medical equipment, Pharmaceuticals, and supplies.

Next Big Thing in Investing: Artificial Intelligence

Right now it seems that artificial intelligence (AI) is driving that bus and will be for the foreseeable future. AI has the potential to change how we do everything — from the way we shop to how businesses are run.

Wayfair Inc. (NYSE:W), Match Group, Inc. (NASDAQ:MTCH), and Palantir Technologies Inc. (NYSE:PLTR) are some of the stocks that will double in 2024, besides StoneCo Ltd.

Key Takeaways: Growth stocks may see a robust 2024 on the strength of trends such as AI disruption and decarbonization. Small-cap stocks are trading at attractive valuations as analysts see the possibility of a rebound in 2024. The time could be right for locking in rates on long-term, high-yield bonds.

Vanguard's active fixed income team believes emerging markets (EM) bonds could outperform much of the rest of the fixed income market in 2024 because of the likelihood of declining global interest rates, the current yield premium over U.S. investment-grade bonds, and a longer duration profile than U.S. high yield.

1. Positive returns -- but smaller than in 2023. I think that the overall stock market will deliver positive returns in 2024. However, I expect those returns to be somewhat smaller than they were last year.

Some of the best stocks to invest in 2024 for beginners include Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN), and Mastercard Incorporated (NYSE:MA). For this list, we used a stock screener and selected stable companies with high single digit or low-teens revenue growth.

What is the smartest thing to invest in right now?

Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a bit). Stocks have consistently proven to be the best way for the average person to build wealth over the long term.

Key Findings. The federal funds rate is expected to drop by 150 basis points (1.5%), from 5.3% to 3.8%, by the end of 2024. Commercial lending rates are almost certain to drop alongside the federal funds rate, providing an opportunity for borrowers to refinance high-interest loans.

Amazon has a conensus rating of Strong Buy which is based on 41 buy ratings, 0 hold ratings and 0 sell ratings. The average price target for Amazon is $208.23. This is based on 41 Wall Streets Analysts 12-month price targets, issued in the past 3 months.

Based on analyst ratings, Costco's 12-month average price target is $723.70. Currently there's no upside potential for COST, based on the analysts' average price target. Costco has a conensus rating of Strong Buy which is based on 21 buy ratings, 7 hold ratings and 0 sell ratings.

The top picks for 2024, chosen for their stability, income potential and expert management, include Dodge & Cox Income Fund (DODIX), iShares Core U.S. Aggregate Bond ETF (AGG), Vanguard Total Bond Market ETF (BND), Pimco Long Duration Total Return (PLRIX), and American Funds Bond Fund of America (ABNFX).

Mortgage rates are likely to trend down in 2024. Depending on which forecast you look at for housing market predictions in 2024, 30-year mortgage rates could end up somewhere between 5.9% and 6.1% by the end of the year.

As for fixed income, we expect a strong bounce-back year to play out over the course of 2024. When bond yields are high, the income earned is often enough to offset most price fluctuations. In fact, for the 10-year Treasury to deliver a negative return in 2024, the yield would have to rise to 5.3 percent.

Key Takeaways. Potential economic obstacles in 2024 could delay the start of a sustained bull market, but investors can still find opportunities. Consider staying cautious on U.S. stocks while shifting to bonds for potential income and capital gains.

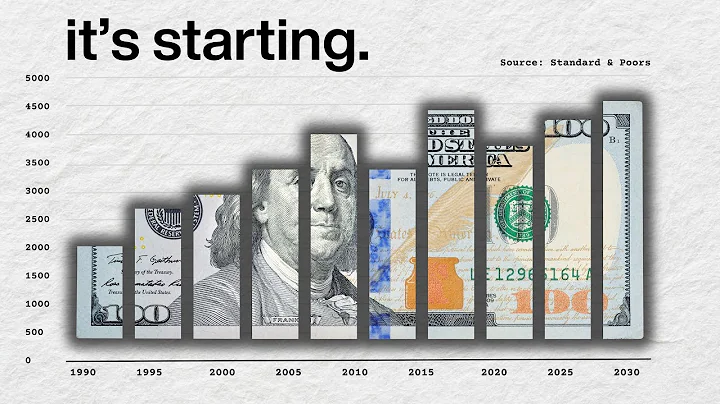

Analysts expect overall S&P 500 earnings to rise 9.5% in 2024 after increasing around 4% in 2023, LSEG data showed. But valuations have risen along with stock prices.

As for how the stocks will perform in the coming election year, 2024 forecasts for the S&P 500 vary widely, but the consensus seems to fall in the range of 8%-9% gains, a little under the index's historical average of about 10%.

What is the safest stock to hold?

In addition to Costco Wholesale Corporation (NASDAQ:COST), Walmart Inc. (NYSE:WMT), and Berkshire Hathaway Inc. (NYSE:BRK-B), The Procter & Gamble Company (NYSE:PG) ranks as one of the safest stocks to invest in. Click to continue reading and see the 5 Safest Stocks To Invest In.

While the quest for a 6% return on your savings today may require some effort, CDs and high-yield savings accounts are two viable options to consider. These accounts offer competitive interest rates, safety through FDIC insurance and ease of management.

Conventional wisdom holds that when you hit your 70s, you should adjust your investment portfolio so it leans heavily toward low-risk bonds and cash accounts and away from higher-risk stocks and mutual funds. That strategy still has merit, according to many financial advisors.

The Bottom Line

Safe assets such as U.S. Treasury securities, high-yield savings accounts, money market funds, and certain types of bonds and annuities offer a lower risk investment option for those prioritizing capital preservation and steady, albeit generally lower, returns.

The safest way to invest $50,000 would be to put it into a savings account or CD. However, you could also invest in stocks or real estate, start or add to a retirement account, and more. Your goals, risk tolerance, and time horizon until retirement will determine the right choice for you.