What is the entry of a dividend on a balance sheet?

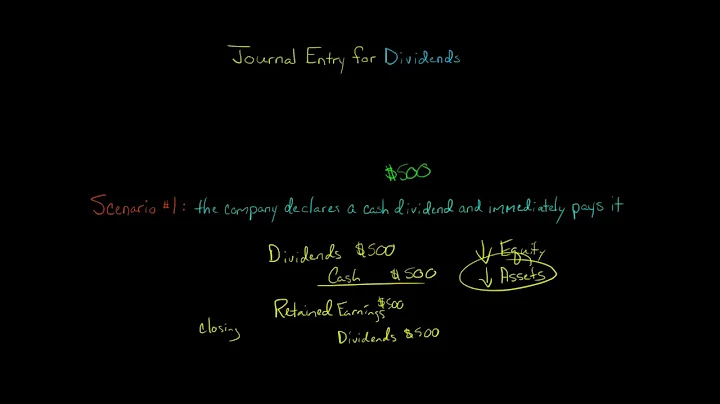

Cash dividends are paid out of a company's retained earnings, the accumulated profits that are kept rather than distributed to shareholders. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account.

Dividends do not appear directly on the balance sheet or the income statement, but they do have an impact on both. Here's how: Balance Sheet: Dividends paid reduce the “Retained Earnings” account under the “Equity” section.

Dividends are paid out of the company's retained earnings, so the journal entry would be a debit to retained earnings and a credit to dividend payable.

- Record the dividend as a liability. Accounting specialists record dividends as a liability under standard accounting procedures. ...

- Debit the company's retained earnings account. ...

- Credit the company's dividends payable account. ...

- Distribute the dividends. ...

- Record the deductions on the date of payment.

The amount allocated for the dividend, which is part of the appropriation of your profit, should appear on the Profit and Loss report after the net profit amount. This does not show, so we suggest you post the dividend entries to a ledger account in the Equity section of your Balance Sheet report.

Cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement. Stock and cash dividends do not affect a company's net income or profit. Instead, dividends impact the shareholders' equity section of the balance sheet.

Treatment of Dividends in Financial Reporting

Under generally accepted accounting principles (GAAP), dividends are not considered an expense of doing business; instead, they are accounted for as a reduction of equity on the balance sheet and added back to net income to compute earnings per share.

There is no separate balance sheet account for dividends after they are paid. However, after the dividend declaration but before actual payment, the company records a liability to shareholders in the dividends payable account.

Record the dividend as a liability

As soon as a company declares a dividend payment, list it as a liability on the company's financial records in the dividend payable account.

Dividend voucher: You must provide each shareholder with a dividend voucher. An electronic version is fine, if previously agreed by shareholders, or the company should send out a paper version in the post to each shareholders. The voucher should include: the company name.

What is the position of dividends on the balance sheet?

Cash dividends affect the cash and shareholder equity on the balance sheet; retained earnings and cash are reduced by the total value of the dividend. Stock dividends have no impact on the cash position of a company and only impact the shareholders equity section of the balance sheet.

Dividends are not reported on the income statement. They would be found in a statement of retained earnings or statement of stockholders' equity once declared and in a statement of cash flows when paid.

To report your dividends on your tax return and pay the applicable taxes, you include the appropriate amounts on Form 1040 and fill out the related line items on Schedule B if required. TurboTax can fill out the proper forms for you by asking questions about dividends you receive throughout the tax year.

Reporting entities often declare dividends on common stock before the balance sheet date, and then pay the dividends after the balance sheet date. Unpaid declared dividends other than stock dividends should be presented as current liabilities.

1. If Company X buys shares from Company Y, X becomes the shareholders of Y. So, when dividend is received by X, the double entry is firstly Dr Cash; Cr Dividend (other income), and at the end of year it will be Dr Dividend; Cr Retaining Earnings? 2.

Dividends paid to shareholders also have a normal balance that is a debit entry. Since liabilities, equity (such as common stock), and revenues increase with a credit, their “normal” balance is a credit.

Cash dividends are paid out of a company's retained earnings, the accumulated profits that are kept rather than distributed to shareholders. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account.

To record a dividend, a reporting entity should debit retained earnings (or any other appropriate capital account from which the dividend will be paid) and credit dividends payable on the declaration date.

Crediting to Demat Accounts: The DP or RTA then processes the dividend payments and credits the respective amounts into the bank accounts linked to the investors' demat accounts.

The total lamount of dividends paid during a period is shown on the Profit and Loss Statement for that period, since they are paid before the calculation of the Retained Profit. Since a P&L Statement is for a period, then all items on it should start at zero again for the next period.

How to record dividends received in financial statements?

Assuming that the company uses the fair value method and not the equity method or consolidation method, then the company would record dividend income from an investment by debiting cash and crediting dividend income. Dividend income would be a non-operating gain in the income statement.

Since Distributions are not an Expense, the display of the Distribution account will appear on your Balance Sheet under the Equity section.

Dividends appear in the equity section of the balance sheet. The income statement also shows the number of shares outstanding after a stock dividend is declared.

You'll find these in a company's 10-K annual report. Here is the formula for calculating dividends: Annual net income minus net change in retained earnings = dividends paid.

Dividends are recorded when declared payable and not when actually paid. Remitted profits of unincorporated enterprises are recorded at the time of remittance. Reinvested earnings are recorded in the period in which the related profits are earned.